Improving bank downtime communication

Independently led the project from data analysis, research to UI & interaction design.

About RazorpayX

Businesses use the RazorpayX platform as well as the payment APIs to make various kinds of payouts. These can be to:

- Customers for Refunds, rewards, and earnings

- Employees for Salaries and petty cash

- Vendors for Invoice and advance payments

Overview

There are banks and

financial services involved in processing a payouts. Any disruption in services stops

payouts

from being processed and these are called downtimes.

On average, 4.13L or 15.3% of affected payouts processed through RazorpayX are due to bank

downtimes. Through this project, we now set better expectations with the users about these

downtimes and the status of their payout.

Impact

1x Head of Product Design (reviewer)

1x Product Manager

1x Front-end engineer

4x Back-end engineers

Problem Statement

Banks experience both scheduled and unscheduled downtimes. While scheduled downtimes typically

cause minimal disruption, unscheduled downtimes during business hours can disrupt user payouts,

resulting in delayed payments and blocked cash flow.

How can we effectively

communicate downtime details to users for both scheduled and unscheduled

events?

Taking a birds eye view of the payouts

data from last 3 months

Current Journey

Pain points

Solution

- Pro-actively communicating with the users about the partner bank & beneficiary bank downtimes, so that users can make an informed decision.

- Create awareness around the security, convenience & value of the features Razorpay provides - this would help with the retention rates.

- Additionally, we also addressed these concerns for our API users by providing information within the webhooks so they can always retrieve the downtime information in real time and modify comms on their platform.

Beneficiary bank alerts

When a recipients account is down, it’s important for us to let the user know of the same so that either they can queue the payout or in urgent scenarios, ask the recipient for another account.

Partner bank alerts

When a user is selecting their bank account and the bank is facing a downtime, we

again

surface the alerts at this stage. This let’s users make a conscious call on how they

want to

handle their payout.

The alert has been styled in an informational format as this doesn’t block the user

for more

than 60mins as Razorpay is able to queue and automatically process the payouts.

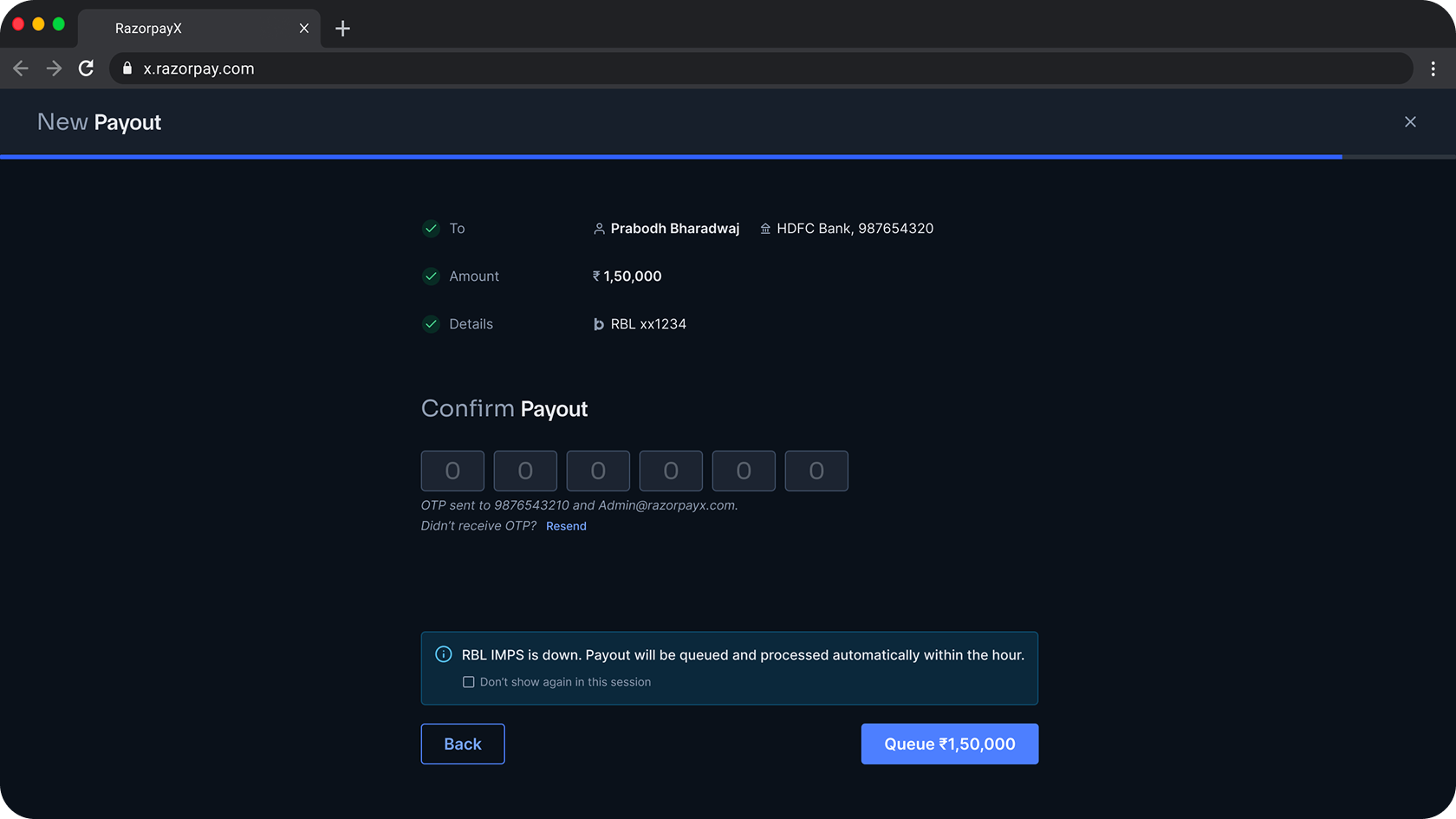

Alerts at OTP step

This is the final point of decision for a payout. So it’s important to confirm with

the user

whether it’s a bene bank downtime or a partner bank downtime. Users always have the

option

to dismiss the alert for that session.

The CTA is modified to ‘Queue ₹X’ to set expectations with the user on what’s going

to

happen next.

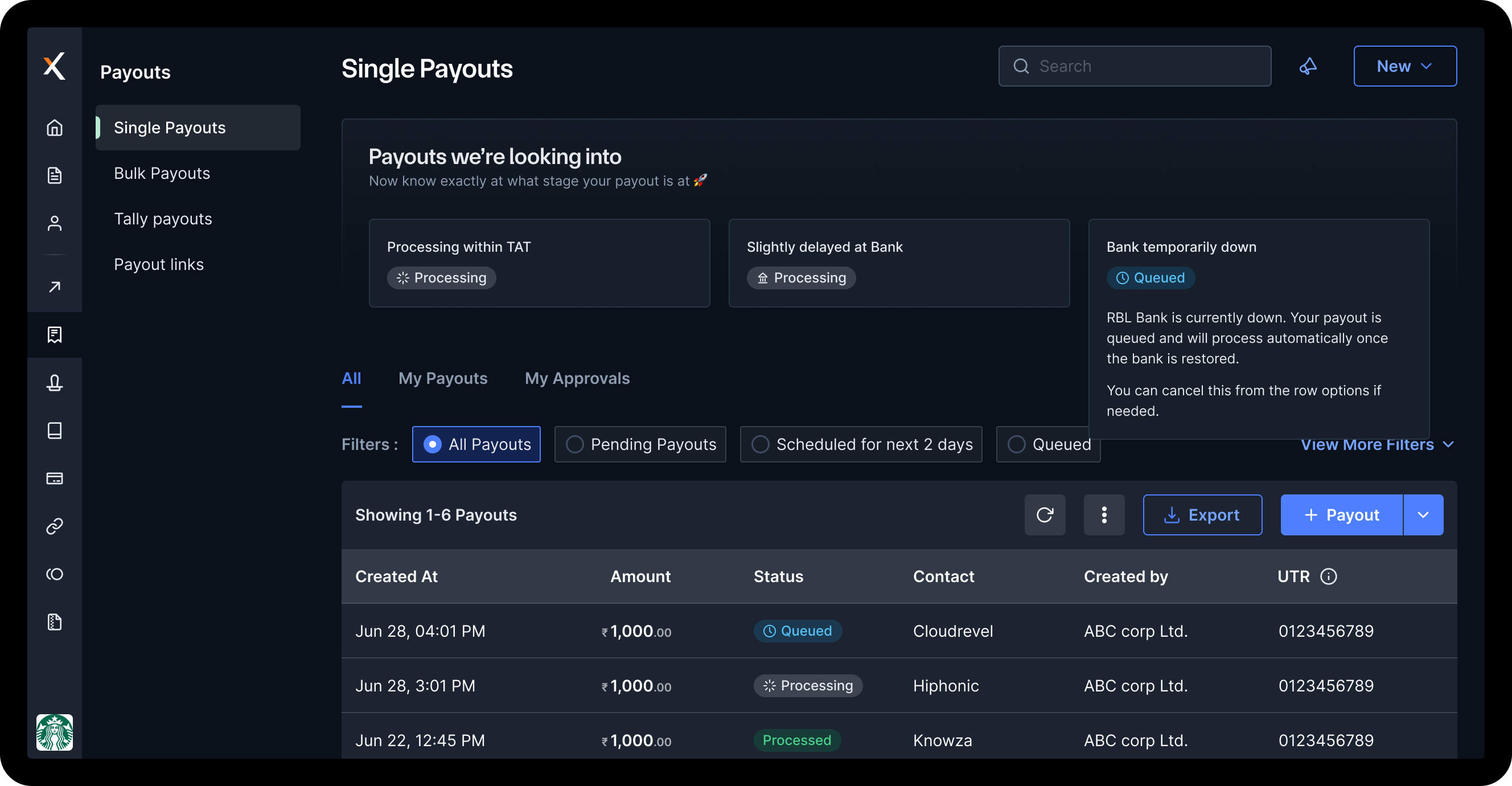

Providing queued confirmation

This is a very important step to bring clarity to the user on where their payments are getting stuck. This clarity helps change user’s perception that any downtime is Razorpay’s downtime.

Post payment user awareness

Once a payout is created and queued, users should be able to access their payouts, what the status means and how long they should wait for the payout to process. The widget on the dashboard as well as the information for the individual payout details target exactly that and keep the users updated.

Impact

What’s Next?

#1 Provide a success rate dashboard for banks

This dashboard should help users understand how different banks perform which enables them to choose their banking partner or raise queries/disputes when needed.

#2 Payout summary dashboard

This dashboard acts as the single point of contact for users to understand what their payout success rates have been, the status distribution and alert if any in the given time frame. This also becomes an important area for us to upsell/cross-sell any features that would improve the payout performance

and more...